Real Estate Market Report Q2 2023

Economic situation

Inflation continues its downward trend despite a slight rise in June due to a base effect. Consensus Economics forecasts an inflation rate of 6.0% over the course of 2023, but this falls to 2.5% for 2024. Second-round effects are likely to remain manageable and the stubbornly high core inflation rate should be forced into a downward trajectory. With real incomes rising as a result, private consumption should also pick up again in the second half of the year.

Property yield, inflation, swap rate, government bond

*Net initial yield

Source: Avison Young, Federal Bank of Germany, Macrobond; Status: July 2023

Office take-up versus ifo Employment Barometer

* Top 5 Cities, 12 months rolling; **Index, Base year 2015, 3 quarters ahead

Source: Avison Young, ifo Institute; Status: July 2023

Investment market

Pricing continues to be a tough and wearisome process. Sellers often set their price expectations too high, resulting in many sales processes being terminated before completion. Prospective buyers are holding back while players who are willing to sell are ‘running into’ a period of continually falling prices. Buyers and sellers are not yet coming together in terms of pricing. This is likely to change over the coming quarters, as more follow-up financing has (had) to be concluded on significantly more expensive terms and conditions, and more collateral is required, especially if reduced property values mean a capital shortfall. This often necessitates an equity injection which is often not affordable for the borrower. In many cases, this will result in sales instead. Even real estate funds will have to generate cash through sales to be able to service share payouts.

Commercial real estate investment volume Germany

Source: Avison Young

Status: July 2023

As a slight fall in the yield for 10-year German government bonds is expected in the same period, the yield gap between real estate and bonds will widen further. By the end of 2023, this yield gap is expected to be around 200 basis points (average prime yield for office properties in the largest German real estate markets compared to the government bond), which will make real estate investments significantly more attractive again.

Office prime yield

Source: Avison Young

Status: July 2023

Office letting markets

Take-up top 4 cities

Source: Avison Young

Status: July 2023

Office prime rents and office vacancy rate

Source: Avison Young

Status: July 2023

As many leases that are now expiring were concluded at times of significantly lower rents, occupiers in the office market are finding that circumstances have changed. With many projects now being delayed, prospective tenants must plan a relocation with a longer lead time. Moreover, the supply of new buildings will remain limited over the coming years, among other reasons since speculative developments will usually not be realised currently.

Berlin office market

| Q2 2023 | compared to previous year | Outlook* | |

| Take-up (m²) | 253,600 | -31 % | ↓ |

| Prime rent (€/m²/month) | 44.00 | +3.00 € | ↑ |

| Average rent (€/m²/month) | 28.60 | +0.10 € | |

| Vacancy rate (%) | 4.1 % | +90 bp | ↑ |

* in each case by end of year,

except take-up: compared with previous year

Source: Avison Young

Status: July 2023

Take-up, vacancy and prime rent

Source: Avison Young

Status: July 2023

Take-up by Top 5 Sector

Source: Avison Young

Status: July 2023

Take-up by size category

Source: Avison Young

Status: July 2023

Top 5 Deals

| Boston Consulting Group (BCG) „AP 15“ – Mediaspree |

19,200 m² |

| Jobcenter Marzahn-Hellersdorf East |

12,800 m² |

| Banking / Finance „X8“ - Friedrichshain-Kreuzberg |

5,500 m² |

| PAO Gazprom „the Graph“ – Friedrichshain-Kreuzberg |

5,500 m² |

| BIMA „Lichtwarte“ – Mitte |

5,300 m² |

Completions

Source: Avison Young

Status: July 2023

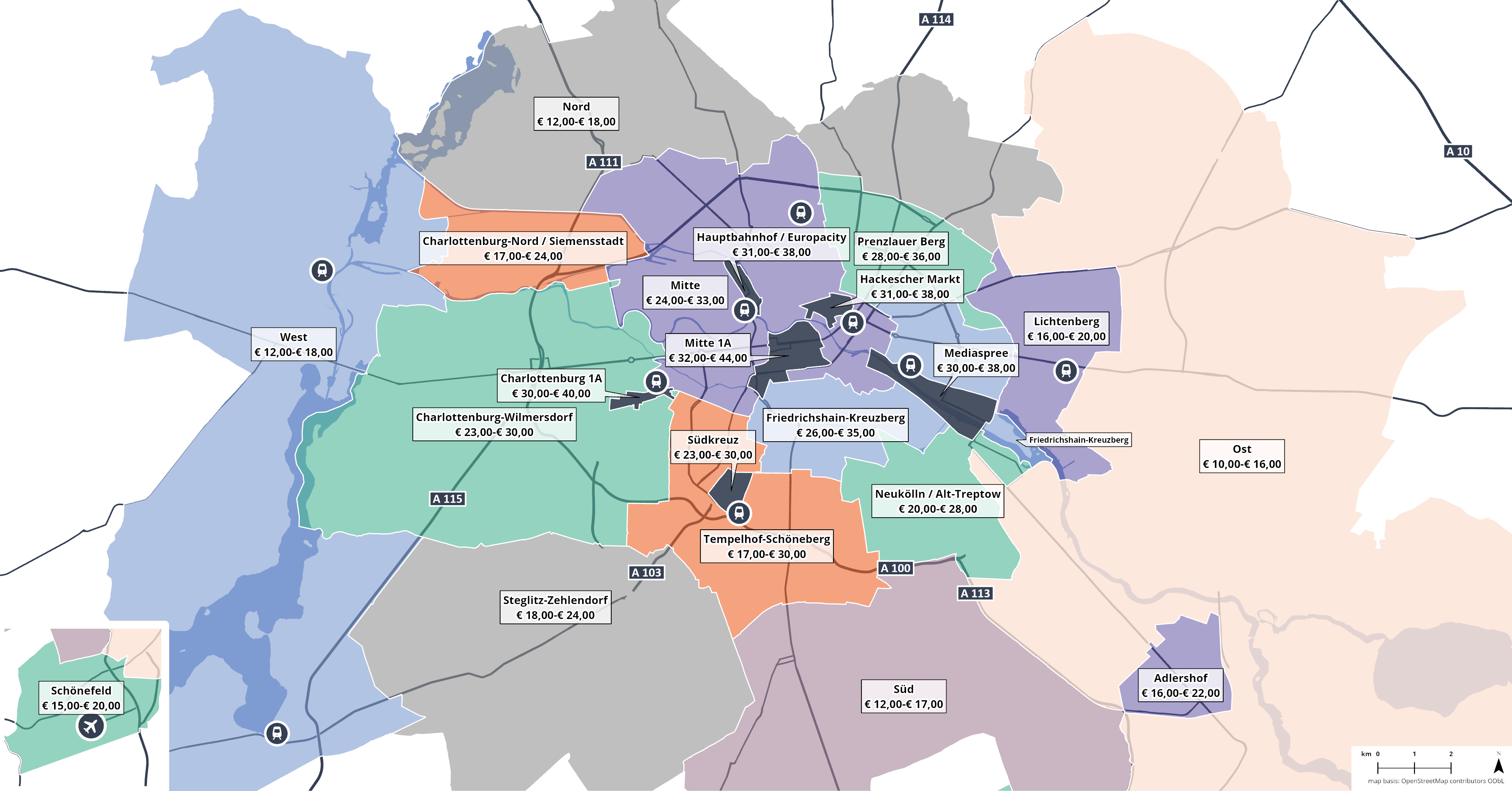

Rental bands - Berlin q2 2023

Source: Avison Young

Status: July 2023

Dusseldorf office market

| Q2 2023 | compared to previous year | Outlook* | |

| Take-up (m²) | 89,200 | -53 % | ↓ |

| Prime rent (€/m²/month) | 38.00 | +8.00 € | → |

| Average rent (€/m²/month) | 20.30 | +2.75 € | |

| Vacancy rate (%) | 9.3 % | +120 bp | ↑ |

except take-up: compared with previous year

Source: Avison Young

Status: July 2023

There are still some large-scale enquiries in the market, but these are unlikely to be be concluded until 2024, or tenants will opt to extend their leases in existing properties. Momentum is expected to return to the market next year. Until then, more landlords are prepared to increase their package of incentives and reduce nominal rents. There have been some significant reductions, depending on the location and property. A stagnation in prime rents is expected over the second half of the year, because demand for high-quality space is still there, even if some companies are reducing their overall space requirements.

Take-up, vacancy and prime rent

Quelle: Avison Young

Stand: Juli 2023

Take-up by Top 5 Sector

Source: Avison Young

Status: July 2023

Take-up by size category

Source: Avison Young

Status: July 2023

Top 5 Deals

| Hengeler Müller „Trinkhaus-Karree“ – CBD |

9,600 m² |

| NGK Spark Plug Europe „The Square“ – Ratingen |

5,600 m² |

| Munichfashion.company „Kennedypark“ – Kennedydamm |

4,200 m² |

| Ed. Züblin „F101“ – Airport City |

4,200 m² |

| Wayss & Freitag „OASIS 31 „ - West |

2,400 m² |

Completions

Source: Avison Young

Status: July 2023

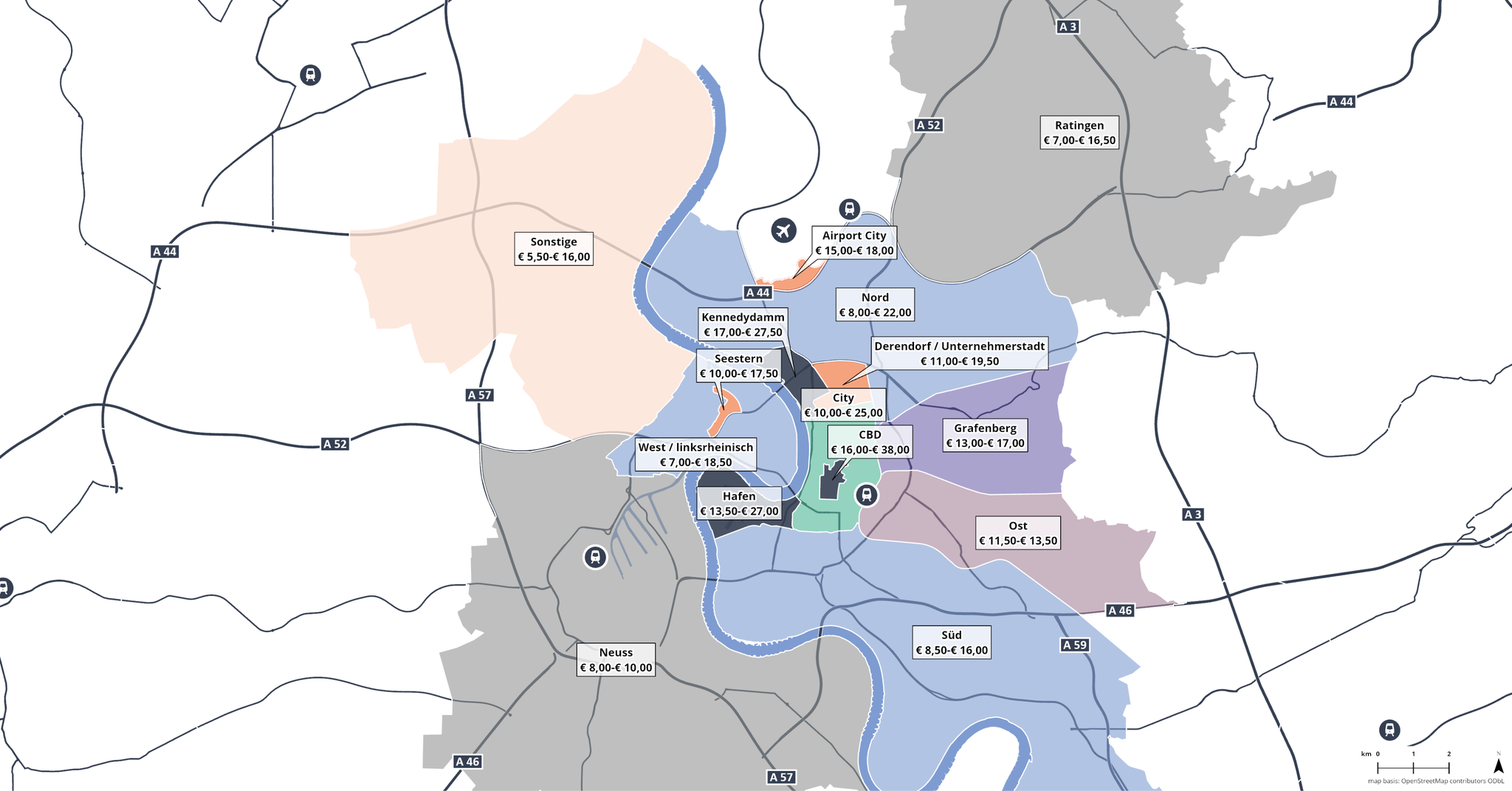

Rental bands - Dusseldorf q2 2023

Source: Avison Young

Status: July 2023

Frankfurt office market

| Q2 2023 | compared to previous year | Outlook* | |

| Take-up (m²) | 183,700 | -6 % | → |

| Prime rent (€/m²/month) | 46.50 | 0.00 € | ↑ |

| Average rent (€/m²/month) | 23.70 | +1.30 € | |

| Vacancy rate (%) | 8.8 % | +70 bp | ↑ |

* in each case by end of year,

except take-up: compared with previous year

Source: Avison Young

Status: July 2023

Take-up, vacancy and prime rent

Source: Avison Young

Status: July 2023

While (major) banks are consolidating their locations and total space, and the largest law firms are not currently concluding large-scale deals, HR and management consultants are highly active in the high-end market segment and are increasing their office footprints, often in central and expensive locations. Since fewer large deals are likely to take place in the near future, this poses challenges for many Frankfurt owners, for example in terms of how standard floor plates can be subdivided for smaller lettings where the overall infrastructure makes it feasible at all.

Parallel to the increase in the overall vacancy rate, the short notice availability of high-quality space in central locations is increasingly scarce, partly due to the lack of suitable product in the construction pipeline. This in turn will result in a further hike in prime rents.

Top 5 Deals

| Universal-Investment-GmbH „Timber Pioneer“ – Europaviertel / Messe |

9,600 m² |

| Staatliches Schulamt Frankfurt Sossenheim / Rödelheim/ Hausen |

9,100 m² |

| Eintracht Frankfurt Süd |

8,800 m² |

| Massif Central „Bethmannhof“ – Innenstadt |

5,800 m² |

| American Express „The Spin“ - Europaviertel / Messe |

5,000 m² |

Completions

Source: Avison Young

Status: July 2023

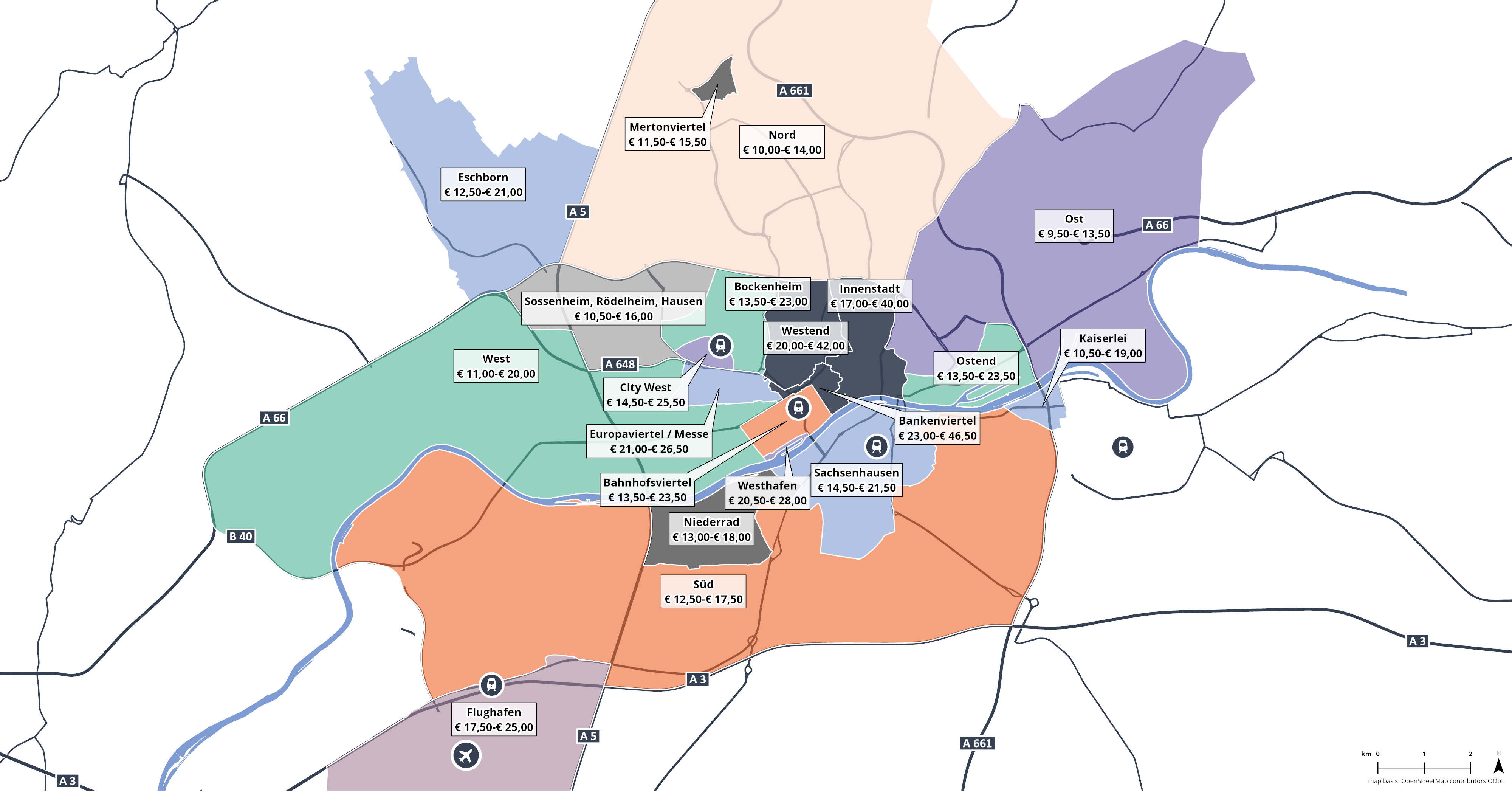

Rental bands - Frankfurt q2 2023

Quelle: Avison Young

Stand: Juli 2023

Hamburg office market

| Q2 2023 | compared to previous year | Outlook* | |

| Take-up (m²) | 220,000 | -29 % | ↓ |

| Prime rent (€/m²/month) | 35.00 | 0.00 € | ↑ |

| Average rent (€/m²/month) | 21.10 | +0.20 € | |

| Vacancy rate (%) | 3.8 % | +10 bp | ↑ |

* in each case by end of year,

except take-up: compared with previous year

Source: Avison Young

Status: July 2023

The principal focus of many occupiers in Hamburg is on quality. Accordingly, there have been numerous pre-lets in project developments. However, even occupiers who are not looking for a new-build property but whose quality requirements are unfulfilled from the available existing stock, for example in terms of location, size and layout, are opting to lease space in a development. In return, these tenants commit to long leases with no break options, which is typical in the project development sector. Other tenants seeking to bridge the current period of uncertainty would like to extend their lease for just one or two years at first, rather than be forced into making long-term decisions.

Take-up, vacancy and prime rent

Source: Avison Young

Status: July 2023

Overall. the outlook for the second half of the year is positive: while office take-up may reach 450,000 sq m for the full year, just 7% below the five-year average, there is further potential for rental price rises in the prime segment.

Take-up by Top 5 Sector

Source: Avison Young

Status: July 2023

Take-up by size category

Source: Avison Young

Status: July 2023

Top 5 Deals

| RTL Harbour City |

17.200 m² |

| Bürgerschaft Hamburg City |

9,850 m² |

| Deutsche GigaNetz „TRIIIO Hamburg“ – City |

7,250 m² |

| Telefónica Germany GmbH „Tichelhaus“ – City |

7,000 m² |

| IU Internationale Hochschule „Zeughaus“ – Eppendorf / Hoheluft |

6,800 m² |

Completions

Source: Avison Young

Status: July 2023

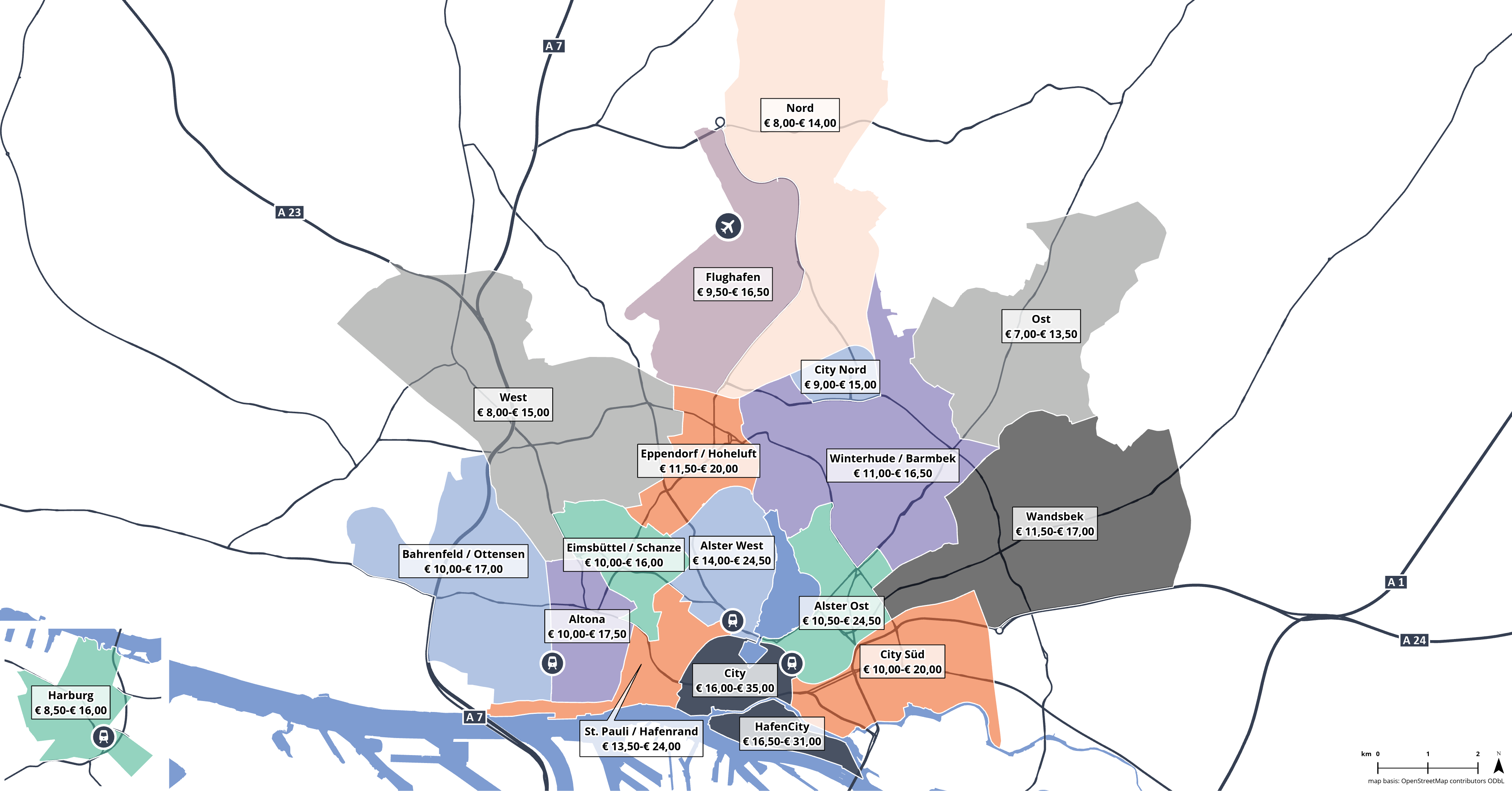

Rental bands - Hamburg q2 2023

Source: Avison Young

Status: July 2023

Kontakte

- Director Market Intelligence, Germany

- Innovation and Insight

- Senior GIS & Research Analyst

- Innovation and Insight