Market Report q2 2024

Economic conditions

The ifo Business Climate Index fell in June after three consecutive increases in the previous months. Conversely, the service sector saw an increase in both the current situation assessment and expectations, marking the fifth consecutive rise in expectations. Alongside other indicators, the overall economic development at mid-year presents a mixed picture, indicating cautious decision-making among companies. However, the economy is still on a recovery path, although this remains sluggish: according to the ifo Institute, the GDP is expected to grow by 0.4% in 2024 and 1.5% in 2025.

Property yield, inflation, swap rate, government bond

Despite a slight drop in Germany's inflation rate to 2.2% in June, the European Central Bank did not lower interest rates again in July. The main reason is the still robust labor market, which, through wage increases—especially in the service sector—exerts inflationary pressure. Even the anticipated one to two more rate hikes this year will not trigger a boom in the real estate investment market, as their effects on long-term financing rates are limited. However, the trend of the interest rate path and the associated confidence in the central bank’s efforts to combat inflation lead to increased security, which, combined with the ongoing economic recovery, provides positive impulses for the real estate market.

Office take-up versus ifo Employment Barometer

The German labor market remains stable: the number of employed persons continues to rise, increasing by 20,000 in May alone, reaching approximately 45.9 million. The unemployment rate, currently at 5.8%, is expected to fluctuate slightly but trend sideways to downward. Employment numbers are projected to continue rising, albeit slightly; the same applies to the number of office employees.

Investment market

While the economy currently sends mixed signals, the commercial real estate investment market is picking up, albeit at a very low level: from April to June, the transaction volume of 5.8 billion euros represents a 12% quarterly and 54% annual increase. This brings the half-year total to 11.1 billion euros, 27% more than the same period last year. However, compared to the five-year average, the volume is still 51% lower, mainly due to the significantly reduced number of large transactions. In this segment, financiers are still very cautious. Several large deals were driven by pressure to act, such as sales through insolvencies. Logistics properties represent the strongest asset class at 24%, followed by retail properties at 23%, and offices close behind at 20%. Little activity is happening in the traditionally strongest risk class, Core. Equity-rich, often local or regional investors are taking advantage of the situation for targeted acquisitions in the Value-Add and opportunistic segments.

More and more owners with existing or potential vacancies must invest in their properties; otherwise, these risk becoming “stranded assets” with no user demand or investors. However, not all can afford to do so. Considerations of repurposing properties are increasingly coming into play, as many offices will no longer be needed in the future. At the same time, there are more distressed situations and non-performing loans, with the number of insolvencies and restructurings expected to remain high for some time. However, more capital is now being allocated for such challenging situations and structures. Some stalled project developments are now being taken over and continued. Examples include the acquisition of Signa’s office and commercial project Hauptwache 1 in Frankfurt am Main—still under construction—by Frankfurter Sparkasse for owner occupancy, or the purchase of the former Kaufhof Am Wehrhahn 1 from Signa subsidiary’s insolvency estate by the city of Düsseldorf for a new opera house. Often, creditors involved in these transactions aim to limit damage. Nevertheless, these transactions also provide some stimulus for the investment market.

More and more owners with existing or potential vacancies must invest in their properties; otherwise, these risk becoming “stranded assets” with no user demand or investors. However, not all can afford to do so. Considerations of repurposing properties are increasingly coming into play, as many offices will no longer be needed in the future. At the same time, there are more distressed situations and non-performing loans, with the number of insolvencies and restructurings expected to remain high for some time. However, more capital is now being allocated for such challenging situations and structures. Some stalled project developments are now being taken over and continued. Examples include the acquisition of Signa’s office and commercial project Hauptwache 1 in Frankfurt am Main—still under construction—by Frankfurter Sparkasse for owner occupancy, or the purchase of the former Kaufhof Am Wehrhahn 1 from Signa subsidiary’s insolvency estate by the city of Düsseldorf for a new opera house. Often, creditors involved in these transactions aim to limit damage. Nevertheless, these transactions also provide some stimulus for the investment market.

Commercial real estate investment volume

Price discovery is already well advanced: in the office segment, prime yields remained stable at 4.64% on average in the Big-5 markets. They are expected to maintain this level until the end of the year, with a slight decline possible in 2025. Despite increased dynamism, transaction volumes are still very low, with some segments even experiencing a decline in the second quarter. However, 2024 is expected to mark a turning point for real estate markets overall.

Prime yield

Germany: office markets

Demand for office space still involves a significant portion of lease renewals. However, some markets saw higher—statistically significant—new lease volumes in the first six months of the year compared to the same period last year, while others saw declines. The development of rental markets is closely tied to the overall economic recovery, which is also hesitant and uneven. Overall, the rental volume for the considered real estate markets in Berlin, Hamburg, Düsseldorf, and Frankfurt totaled 764,600 m², representing a 1% year-on-year decline and 18% below the five-year average.

Take-up: Berlin, Dusseldorf, Frankfurt, Hamburg

There is tenant activity—viewings, calculations, and evaluations—but many tenants withdraw their requests and renew existing leases after lengthy processes. Demand for top-quality spaces, although a small market segment, supports or even drives up prime rents. Moreover, some planned project developments are postponed if they do not achieve the significantly higher pre-leasing rates required for financing. Long-term leases are crucial for developers, but many users are currently unwilling to commit to long-term contracts. This limits the supply of new, high-quality spaces in several submarkets.

Office prime rents and vacancy rates

Total vacancy rose slightly by the end of June, mainly due to reduced space usage resulting from increasingly widespread hybrid working models. Besides lower new leasing volumes, there are reductions through partial space returns during lease renewals or offering surplus space for sublease.

Once economic and especially policy uncertainty decreases, planning security and companies' willingness to make decisions should return, positively affecting office rental markets. Economic momentum is gradually increasing, employment prospects are quite positive, and the initiated interest rate turnaround brings some relief to businesses.

Once economic and especially policy uncertainty decreases, planning security and companies' willingness to make decisions should return, positively affecting office rental markets. Economic momentum is gradually increasing, employment prospects are quite positive, and the initiated interest rate turnaround brings some relief to businesses.

Berlin office market

Compared to the five-year average, Berlin's office space take-up at mid-2024 saw an 18% decline, despite five large deals over 10,000 m²—three of them in the second quarter. Some of these deals involved owner-occupiers whose construction starts have now entered the statistics. Public sector transactions remain the dominant driver by industry. High activity continues in lease renewals. There is an availability of “better spaces,” but users often remain hesitant about new leases and relocations.

Vacancy reached 1.32 million m², a level last seen in 2011, with a rising trend. Many tenants attempt to sublet their unused units, often at significantly lower rents and shorter terms than the owner, who also tries to lease additional vacant spaces in the building, leading to very different conditions within the same properties. Increasing vacancy prompts more owners to consider converting office space to commercial housing. This doesn't necessarily involve sales; leasing to operators is also a viable option.

After some submarket rent adjustments downward in the first quarter, they remained stable in the second quarter. The pressure for further—also nominal—rent corrections remains high, suggesting more downward adjustments could follow. Incentives (landlord concessions) vary depending on location, property, and business plan, with an upward trend. Prime rents are expected to remain stable until the end of the year.

Vacancy reached 1.32 million m², a level last seen in 2011, with a rising trend. Many tenants attempt to sublet their unused units, often at significantly lower rents and shorter terms than the owner, who also tries to lease additional vacant spaces in the building, leading to very different conditions within the same properties. Increasing vacancy prompts more owners to consider converting office space to commercial housing. This doesn't necessarily involve sales; leasing to operators is also a viable option.

After some submarket rent adjustments downward in the first quarter, they remained stable in the second quarter. The pressure for further—also nominal—rent corrections remains high, suggesting more downward adjustments could follow. Incentives (landlord concessions) vary depending on location, property, and business plan, with an upward trend. Prime rents are expected to remain stable until the end of the year.

Take-up, vacancy and prime rent

Take-up by Top 5 Sector

Take-up by size category

Top 5 Deals

Completions

Rental bands - Berlin q2 2024

Source: Avison Young

Status: July 2024

Dusseldorf office market

Compared to the five-year average, Düsseldorf's office space take-up of 106,300 m² in the first two quarters is down by nearly a third, due to a significantly reduced number of large deals: there have only been two deals over 5,000 m² so far this year.

With more frequent and usually quickly concluded lease renewals, the number of inquiries has also decreased, suggesting a weak trend in statistically relevant leasing volumes in the coming months. Meanwhile, large corporates are reviewing improvements to their office locations, often moving from peripheral to city areas, with some optimizing locations within the suburbs. Moreover, companies, especially in city-edge locations, are increasingly considering acquiring properties for their own use if it’s the best option compared to leasing.

The vacancy rate, which exceeded 10% for the first time in 10 years by the end of the first quarter, has slightly increased to 10.3% by mid-year. Office space supply is growing across all locations and quality segments. In high-demand locations, the increasing supply has led many owners to enhance incentives, although nominal rents have remained largely unaffected. However, some owners and (developer) investors are actively considering converting hard-to-market properties to alternative uses. Absolute top-quality products in prime locations continue to find users, potentially leading to further increases in prime rents.

With more frequent and usually quickly concluded lease renewals, the number of inquiries has also decreased, suggesting a weak trend in statistically relevant leasing volumes in the coming months. Meanwhile, large corporates are reviewing improvements to their office locations, often moving from peripheral to city areas, with some optimizing locations within the suburbs. Moreover, companies, especially in city-edge locations, are increasingly considering acquiring properties for their own use if it’s the best option compared to leasing.

The vacancy rate, which exceeded 10% for the first time in 10 years by the end of the first quarter, has slightly increased to 10.3% by mid-year. Office space supply is growing across all locations and quality segments. In high-demand locations, the increasing supply has led many owners to enhance incentives, although nominal rents have remained largely unaffected. However, some owners and (developer) investors are actively considering converting hard-to-market properties to alternative uses. Absolute top-quality products in prime locations continue to find users, potentially leading to further increases in prime rents.

Take-up, vacancy and prime rent

Take-up by Top 5 Sector

Take-up by size category

Top 5 Deals

Completions

Rental bands - Dusseldorf q2 2024

Source: Avison Young

Status: July 2024

Frankfurt office market

Although many leasing inquiries are in the market, there is often a lack of decisiveness to relocate, especially in the mid and large market segments. As a result, the recorded leasing volume of 174,600 m² is 7% below the five-year average. The fact that there has only been one deal above 10,000 m² in six months is unusual for Frankfurt. Nonetheless, an annual volume of 400,000 m² could still be achieved, depending on whether the large inquiries in the market conclude as new leases rather than renewals.

User requirements are increasingly differentiating even within the same submarket. Poorly connected locations are often penalized by tenants moving out. After another slight increase in the second quarter, Frankfurt’s vacancy volume now stands at 1.19 million m². This doesn’t necessarily mean falling rents across the board; on the contrary, not only does the Frankfurt CBD benefit from tenants' “flight-to-quality,” but prime rents in some non-central submarkets have also risen, reflecting the focus on well-integrated locations with urban qualities. While overall prime rent remained stable in the second quarter, a further upward trend is expected over a longer period, with an increase of about one euro likely by year-end. Incentives remained stable in the second quarter, with some owners more open to shorter lease terms.

User requirements are increasingly differentiating even within the same submarket. Poorly connected locations are often penalized by tenants moving out. After another slight increase in the second quarter, Frankfurt’s vacancy volume now stands at 1.19 million m². This doesn’t necessarily mean falling rents across the board; on the contrary, not only does the Frankfurt CBD benefit from tenants' “flight-to-quality,” but prime rents in some non-central submarkets have also risen, reflecting the focus on well-integrated locations with urban qualities. While overall prime rent remained stable in the second quarter, a further upward trend is expected over a longer period, with an increase of about one euro likely by year-end. Incentives remained stable in the second quarter, with some owners more open to shorter lease terms.

Take-up, vacancy and prime rent

Top 5 Deals

Completions

Rental bands - Frankfurt q2 2024

Source: Avison Young

Status: July 2024

Hamburg office market

The second quarter benefited from larger public sector deals and owner-occupier project starts. Four of the five largest deals occurred in the second quarter, with the three largest—all over 10,000 m²—also in the second quarter. Despite this, the leasing volume of 190,300 m² was 14% below the previous year’s result and 21% below the five-year average due to weaker mid-size segment results.

The trend of relocating from decentralized to more central office submarkets continues, often reducing space while accepting a higher relative rent. However, the supply of relevant spaces is thinned out, so many inquiries, even in the small-scale segment, cannot be realized as desired. Compared to other major real estate markets analyzed here, Hamburg has the lowest vacancy rate at 4.5%.

Owner-provided incentives remained unchanged in the second quarter. Due to larger deals with relatively low rents, the average rent decreased. Prime rent remained stable but may soon trend upwards, partly because certain quality and sustainability standards can only be met in high-priced developments. The disparity between top quality and the rest of the market is very pronounced. For example, in the top submarkets City and HafenCity, only two developments offering more than 5,000 m² of office space each, are under construction, expected to be completed by the end of 2025.

The trend of relocating from decentralized to more central office submarkets continues, often reducing space while accepting a higher relative rent. However, the supply of relevant spaces is thinned out, so many inquiries, even in the small-scale segment, cannot be realized as desired. Compared to other major real estate markets analyzed here, Hamburg has the lowest vacancy rate at 4.5%.

Owner-provided incentives remained unchanged in the second quarter. Due to larger deals with relatively low rents, the average rent decreased. Prime rent remained stable but may soon trend upwards, partly because certain quality and sustainability standards can only be met in high-priced developments. The disparity between top quality and the rest of the market is very pronounced. For example, in the top submarkets City and HafenCity, only two developments offering more than 5,000 m² of office space each, are under construction, expected to be completed by the end of 2025.

Take-up, vacancy and prime rent

Take-up by Top 5 Sector

Take-up by size category

Top 5 Deals

Completions

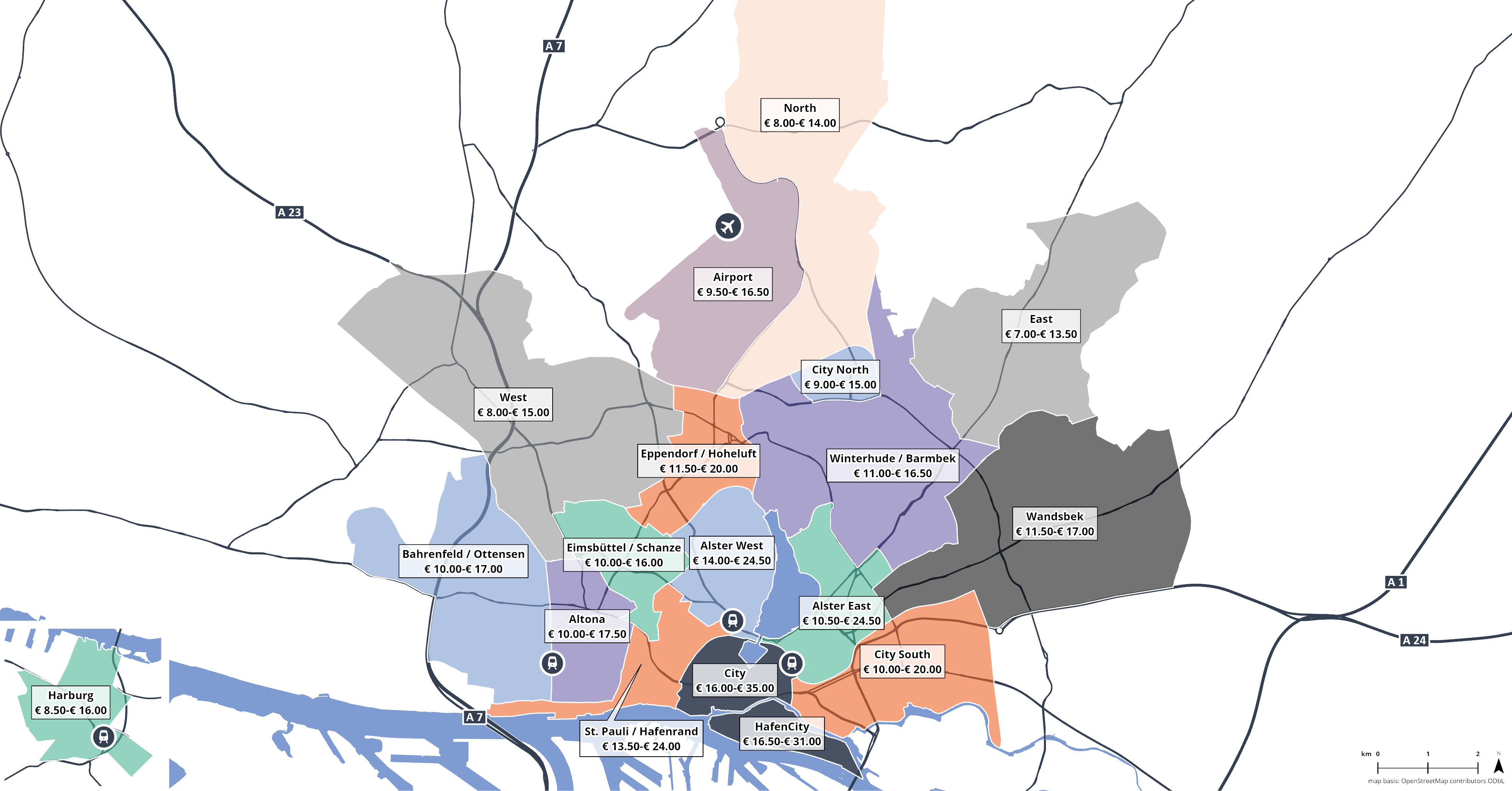

Rental bands - Hamburg q2 2024

Source: Avison Young

Status: July 2024

Kontakte

- Director Market Intelligence, Germany

- Market Intelligence