Market Report q4 2023

Economic conditions

The year 2023 ended for Germany with a slight recession, as the Gross Domestic Product (GDP) recorded a modest -0.3% decline. Meanwhile, key leading indicators relevant to the economic cycle had risen towards the end of the year, some repeatedly. In particular, the expectation components had improved. Nevertheless, their currently achieved relatively low levels in many cases do not yet reflect growth – their upward trend must continue for that to happen. As of the beginning of 2024, the indicators were moving in different directions, presenting a mixed picture by the end of January. The ifo Business Climate indicates a subdued mood among companies, both regarding their current situation and future prospects. Consequently, the year starts with weak signals. However, the recently implemented consolidation measures in the federal budget are expected to only mildly impact economic growth in 2024. Nevertheless, only a slight economic recovery is anticipated for 2024. All economists surveyed within the Consensus Economics survey agree that the German economy will achieve significantly higher growth in 2025 compared to 2024. According to the January survey, the German Gross Domestic Product is projected to reach its long-term average again in 2025. The significantly reduced inflation, robust real wage increases, and record-high employment contribute to the gradual overall economic recovery.

Property yield, inflation, swap rate, government bond

After a prolonged phase of employment growth until the summer of 2023, companies' employment plans are currently subdued. Record employment levels still prevail, but the weak overall economic development has left increasing traces, potentially causing the employment growth to stall temporarily. The unemployment rate has been hovering around the low level of 5.7% for months, and forecasts also anticipate a stable trajectory.

Office take-up versus ifo Employment Barometer

Meanwhile, the overall inflation rate continues to trend downward. The pressure on precursor prices has significantly eased in recent months. However, the path toward the ECB's target of around 2% might take some time, partly due to the addition of some inflationary effects.

Investment market

With an investment volume of approximately €21.2 billion, the year-end result for 2023 was nearly 60% lower compared to both the previous year and the ten-year average from 2013 to 2022. It also marked the lowest transaction volume since 2010 (€19.5 billion). The share of office properties declined to 20% (€4.2 billion), the lowest value ever recorded.

Meanwhile, real estate yields have continued to rise. Over a twelve-month period, prime office yields in the Big-5 markets increased from an average of around 3.30% to 4.48% in the fourth quarter of 2023. We expect yields to continue to rise slightly before reaching their interim peak later in the year; towards the end of the year, they should start to decline again. The market has not developed yet, and the differing price expectations of sellers and buyers are slowly aligning. Nevertheless, 2024 is expected to be a turning point for the German real estate market.

Commercial real estate investment volume

The still weak economy and the trend of declining inflation make a reduction in interest rates by the European Central Bank likely in the middle or second half of 2024, with the key interest rate expected to be lowered by at least 50 basis points from the current level of 4.5%. As this time approaches, more pre-selling activities are likely to be initiated in the real estate market. However, for some highly leveraged properties or owners, the anticipated interest rate cuts may come too late or may not provide sufficient relief to their borrowing costs and conditions. After many sales were already pressured in 2023, this trend is expected to intensify in the coming quarters.

Two significant developments will unfold simultaneously: on one hand, the number of property sales, including fire sales, is expected to increase, and on the other hand, from the second half of the year onwards, the number and variety of returning buyers to the market are expected to rise. Some investors who withdrew from the German market since 2022 now see improved conditions. Smaller investors, for example, are more active in the current market phase compared to the boom years when competition was higher, and prices were elevated. However, they cannot fully compensate for the (lack of) volume from the large buyer groups currently on the sidelines. Overall, an achievable investment volume of €30-35 billion is anticipated for 2024.

Prime yield

Office markets

The economic weakness is manifesting itself in various ways in the office markets, including the fact that many decision-making processes are taking longer. The high number of lease extensions in existing properties, often with shorter terms, reflects, not least, companies' current reluctance to make long-term location decisions. Some potential space inquiries never materialise because landlords make offers to tenants to remain in their spaces long before the lease expiration. Overall, in the analysed office markets of Berlin, Hamburg, Düsseldorf, and Frankfurt, a total office space take-up of 1.6 million square meters was achieved in 2023. This represents a decrease of 20% compared to the year 2022. The variation among individual markets is significant.

Take-up: Berlin, Dusseldorf, Frankfurt, Hamburg

Despite the economically challenging environment, many companies consider the improvement of their office location and quality to be extremely important. Through these optimisations, they often reduce the size of their office space, but there are still examples of a combination of improvement and expansion. However, the reduced space needs resulting from increased hybrid working post-COVID lower the demand level in quantitative terms.

As office space demand closely correlates with economic performance, the predicted gradual economic recovery suggests a gradually revitalising dynamic in the rental markets. The realisation of leasing plans that have not been implemented so far also contributes to this, as many such plans were initially postponed during the heightened uncertainty in the last few quarters.

Office prime rents and vacancy rates

Despite increasing vacancies, further increases in prime rents are expected in all markets throughout 2024, with some markets experiencing a stronger momentum than in 2023. However, at the same time, some segments of the office market face heightened challenges, especially if issues with leasability cannot be resolved (quickly enough).

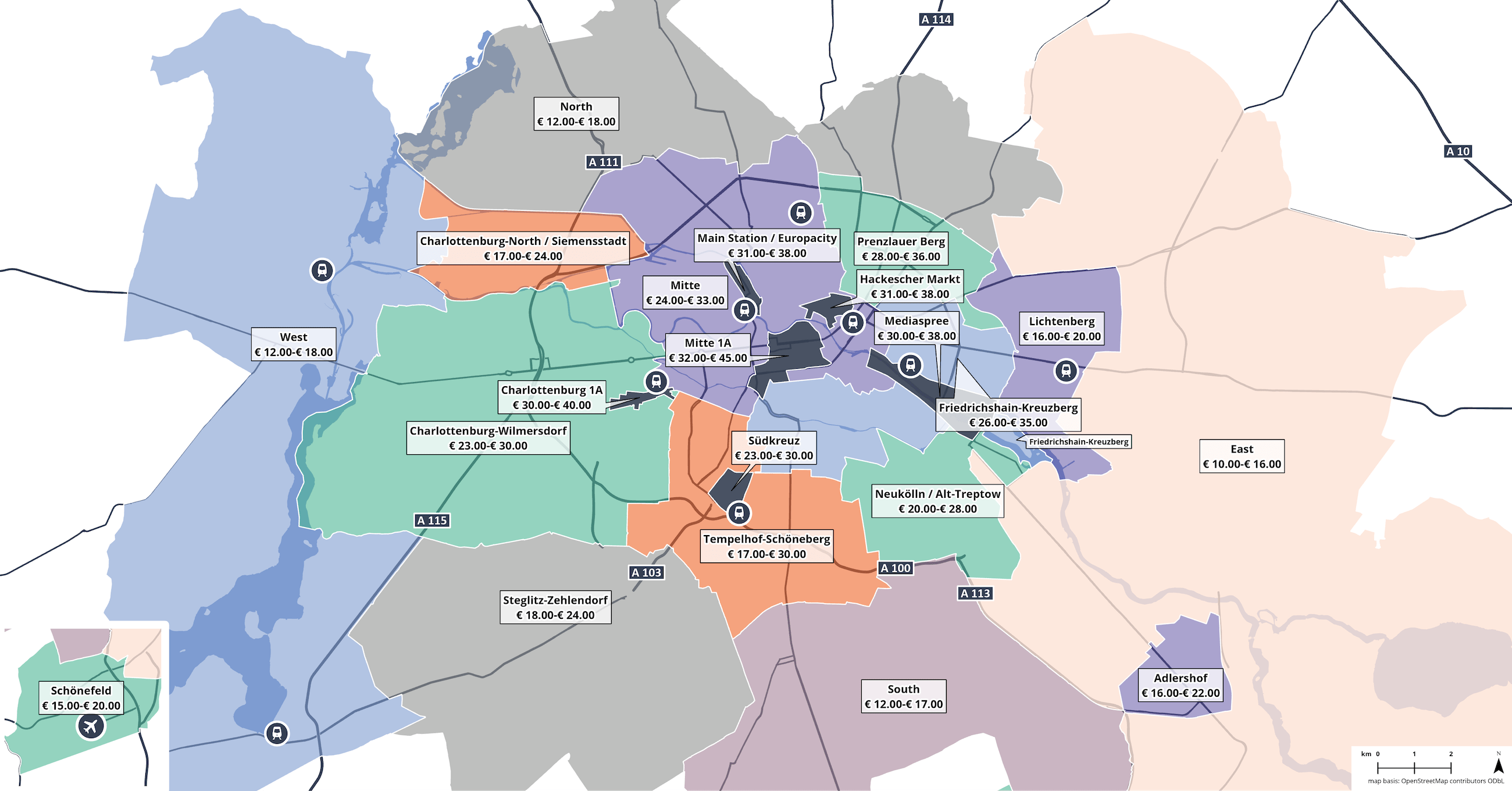

Berlin office market

With an office space take-up of 542,000 m², the result for the year 2023 was 30% below the previous year's figure and 33% below the ten-year average from 2013-2022. The general economic uncertainty was reflected particularly in the low number of large transactions of 10,000 m² or more, of which there were only three, with a total volume of 57,000 m². In 2022, there were nine transactions of this size, totalling 170,000 m².

The vacancy rate increased by 1.3 percentage points to 5.2% compared to the previous year. Given this expansion of supply and declining demand, incentives granted throughout the year increased significantly. However, the simultaneous "flight-to-quality" strategy of many users is reflected in the rise of the prime rent in Berlin by one euro to €45.00/m²/month. The average rent decreased minimally by €0.34. In addition to the already increased vacancies, the large space volumes coming onto the market in the next quarters from the construction pipeline pose a significant challenge for many property owners. Accordingly, for 2024, reductions in nominal rents are expected, especially in locations outside the S-Bahn ring and regardless of location for properties with weaknesses. However, a slight increase in prime rent is expected for 2024.

The 2023 take-up result could be surpassed in 2024. Some inquiries, including large ones, not completed in 2023, are likely to contribute a six-figure take-up volume alone.

Take-up, vacancy and prime rent

Take-up by Top 5 Sector

Take-up by size category

Top 5 Deals

Completions

Rental bands – Berlin q4 2023

Source: Avison Young

Status: December 2023

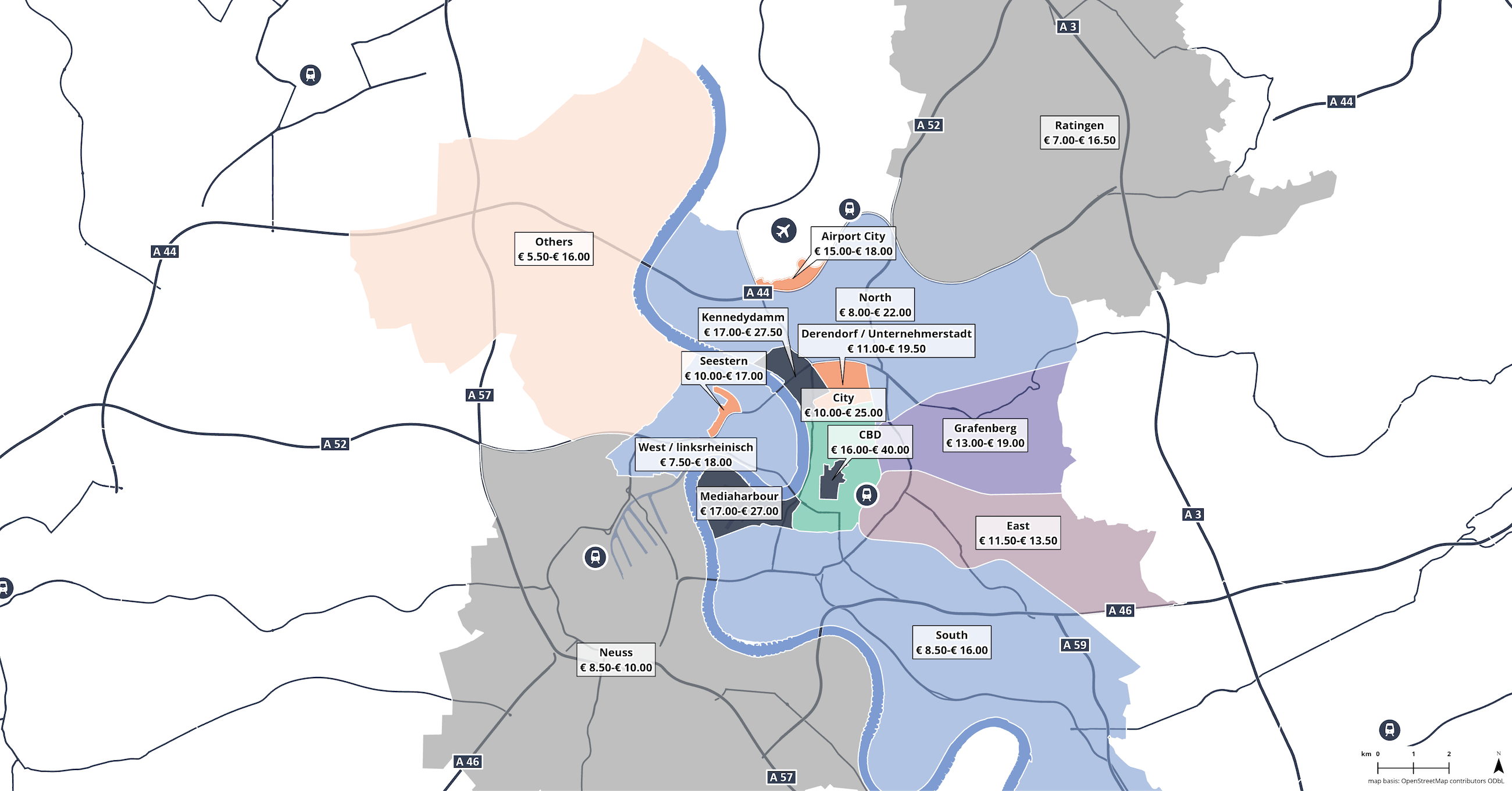

Dusseldorf office market

In 2023, the office space take-up was 4% lower than the previous year, representing a decline of 25% compared to the ten-year average. The very weak first half of the year was primarily responsible for this outcome. However, from the third quarter onwards, there was a revival, especially driven by transactions of 5,000m² and above: out of the nine contracts concluded in the year, seven occurred in the second half.

Regarding achievable rents, two opposing trends can currently be observed. While the prime rent in Düsseldorf had already increased by 19% in 2022, it climbed by another 18% in the following year, reaching a value of €40.00/m²/month at the end of 2023. A short-term reversal is not foreseeable. On the contrary, further increases are likely in 2024, albeit probably to a lesser extent. The main reason is that high-quality properties in prime locations continue to attract companies. Additional, even larger transactions in this market segment are foreseeable, including in development projects. In contrast, landlords in less attractive locations will need to offer more generous incentives to their tenants, and buildings with deficiencies are likely to experience a reduction in nominal rent.

While the increase in vacancies has primarily focused on less-demanded locations and spaces with weaknesses so far, with the volume of sublet spaces continuing to rise, a noticeable expansion of space offerings in the high-quality segment (also) in prime locations is expected for the years 2025/2026. At that time, several major users are anticipated to vacate their current spaces through relocations.

Take-up, vacancy and prime rent

Take-up by Top 5 Sector

Take-up by size category

Top 5 Deals

Completions

Rental bands – Dusseldorf q4 2023

Source: Avison Young

Status: December 2023

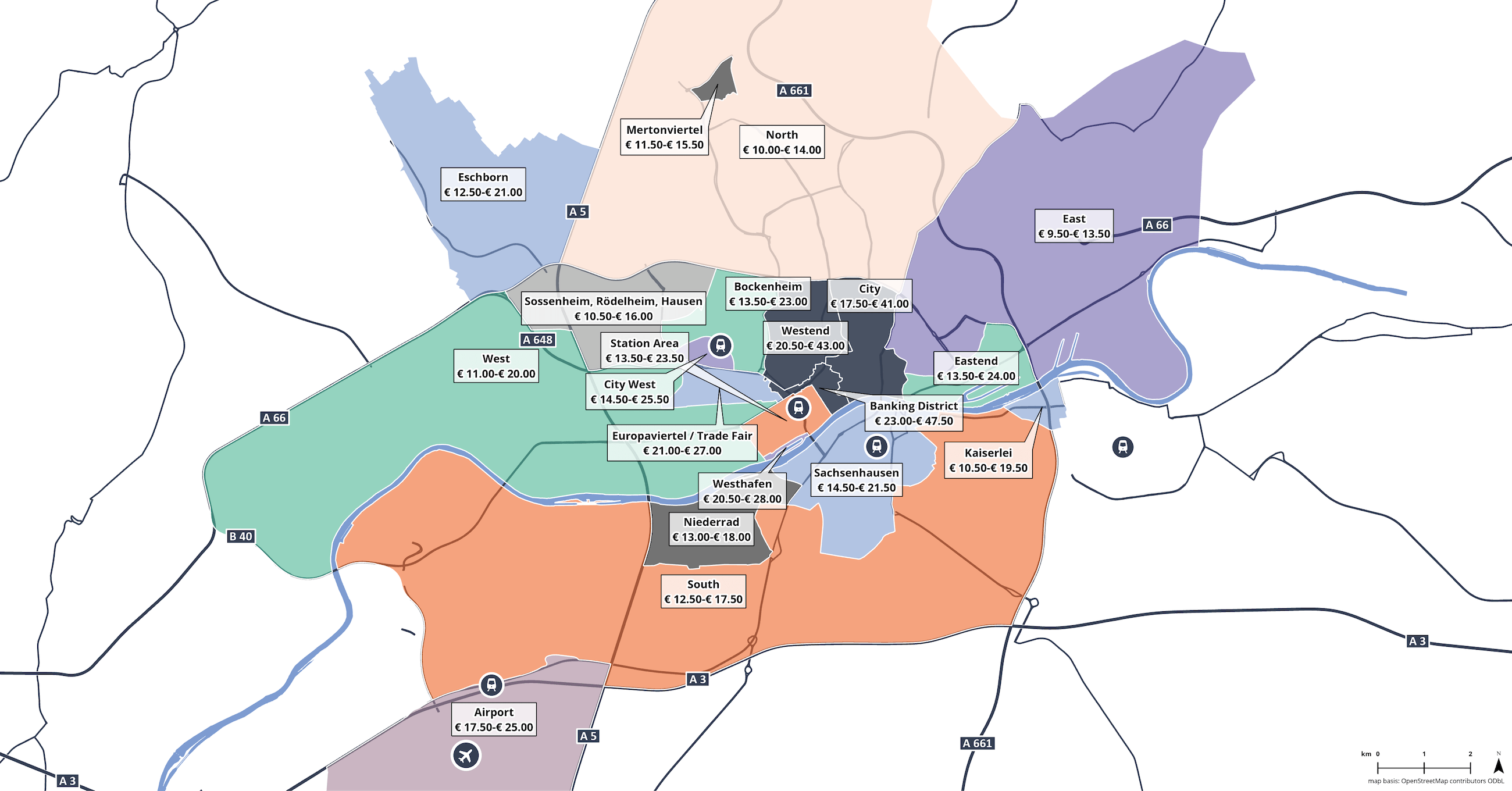

Frankfurt office market

On the Frankfurt office market, there has been a decline in space take-up by 11% compared to the previous year and by 26% compared to the ten-year average. After three large transactions of 10,000m² or more in 2022, totalling around 56,000m², there were two in 2023 totalling 23,000m². There is still active demand in the market, with the main drivers for companies continuing to be location and quality improvements. The demand is predominantly focused on inner-city locations but also extends to other well-integrated submarkets. The high quality expectations of users are evident, with an increase in prime rent observed in six of the 20 office submarkets in 2023. The prime rent in Frankfurt has increased by 2.2% over a twelve-month period, and the €50 mark comes into view in the course of 2024. The reduced construction pipeline, especially in prime locations, gives rents further momentum. On the other hand, reductions in nominal rent are only sporadically observed because they strongly depend on location, product, and the individual situation of the owner. Owners are increasingly focused on risk minimisation. They now take significantly longer than before to submit binding offers. Potential risks are analysed more decisively, and certain tenant industries are even avoided whenever possible.

After the vacancy rate climbed by 1.4 percentage points to 9.4% during the year, further increases are foreseeable, especially when old, inefficient spaces are vacated during relocations. Some of these properties may no longer be marketable as office spaces, making options like total renovation, demolition and reconstruction, or conversion into another type of use necessary.

Take-up, vacancy and prime rent

Top 5 Deals

Completions

Rental bands – Frankfurt q4 2023

Source: Avison Young

Status: December 2023

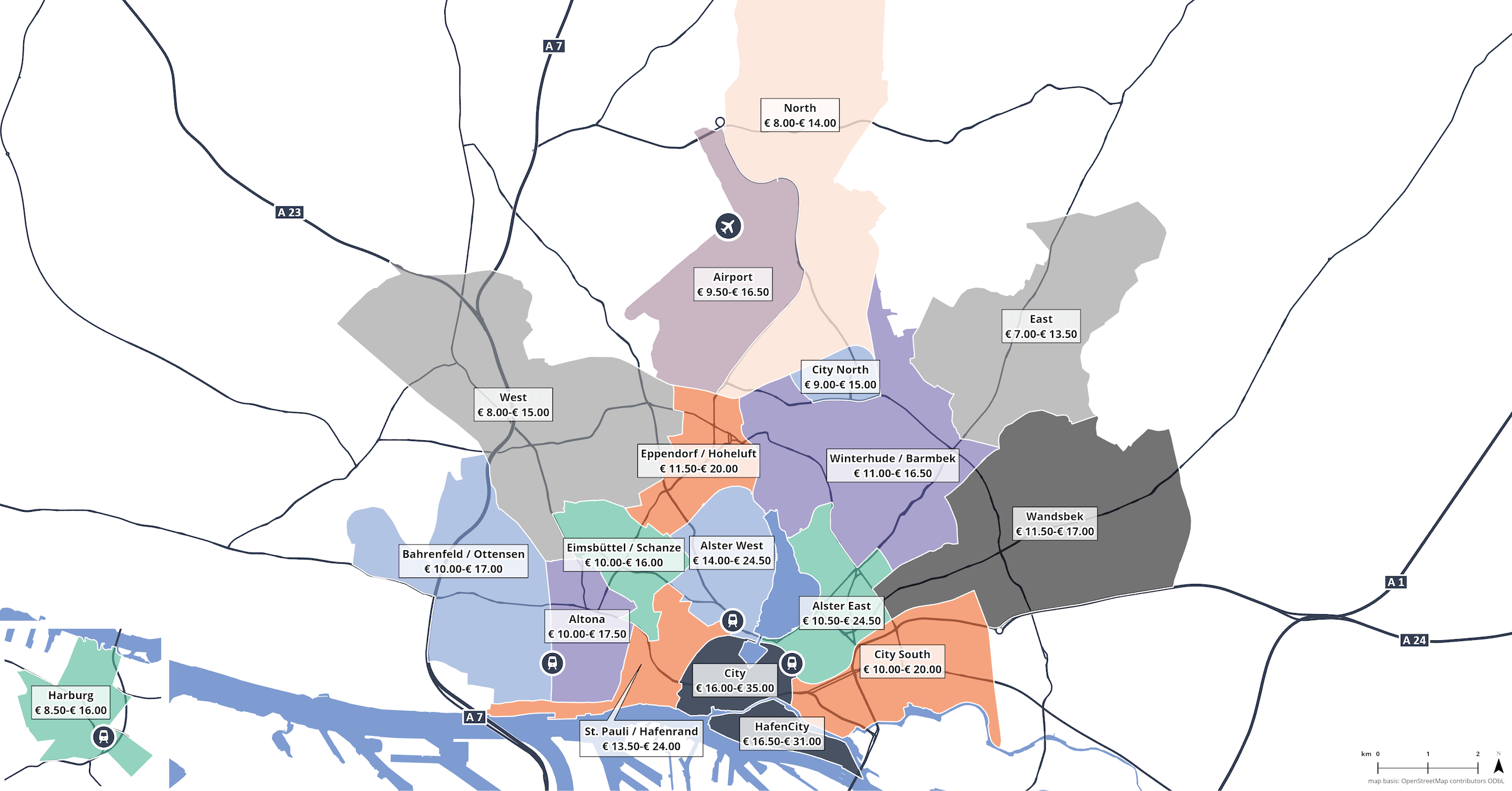

Hamburg office market

The take-up volume for 2023 in Hamburg, amounting to 447,200m², was 20% lower than the previous year and 12% below the ten-year average. Among the markets considered, the Hamburg office market experienced by far the smallest decline compared to the long-term average. Four large transactions, each exceeding 10,000m², significantly contributed to this result. Particularly in these major deals, the prospective improvement in location, property, and spaces played a decisive role in concluding the transactions.

Regarding hybrid working – alternating between the office and home office – most companies have now made their decisions: they see that it works and is highly valued by employees. Accordingly, companies are focusing on optimising their locations and spaces. As this often involves a reduction in the utilized office space, a prospective increase in vacancy is building up in the market as companies vacate their old spaces. In this market segment of older properties, the competition among landlords for tenants is becoming more intense. On the other end of the spectrum, the opposite picture emerges: quality properties are becoming scarcer, partly due to absorption at relatively high rents and partly due to the at least temporary suspension of several providers of potential new construction projects. While the overall market vacancy rate remains low at 4.0%, there is a veritable shortage of offerings in favoured office locations.

Both the rental bands in submarkets and the prime rent remained unchanged throughout the year. In strong submarkets, however, the upper end of the range and the Hamburg prime rent could experience an increase by the end of 2024.

Take-up, vacancy and prime rent

Take-up by Top 5 Sector

Take-up by size category

Top 5 Deals

Completions

Rental bands – Hamburg q4 2023

Source: Avison Young

Status: December 2023

Contact