Real Estate Market Report Q1 2023

Economic conditions

Property yield, inflation, swap rate, government bond

*Net initial yield

Source: Avison Young; Federal Bank of Germany; Macrobond. Status: March/April 2023

Meanwhile, the employment situation in Germany remains robust with the unemployment rate remaining stable at 5.7% in March, as in the previous two months, up from 5.4% at the end of last year and up 60 basis points year-on-year (March 2022: 5.1%).

Office take-up versus ifo Employment Barometer

* Top 5 Cities, 12 months rolling; **Index, Base year 2015, 3 quarters ahead

Source: Avison Young, ifo Institute; Status: March/April 2023

Investment market

Commercial real estate investment volume Germany

Source: Avison Young

Status: March/April 2023

Office prime yield

Source: Avison Young

Status: March/April 2023

Germany: office markets

After a lengthy planning phase, tenants and owner-occupiers have been identifying the working model that works best for them, which in most cases includes regular home office work, and ultimately a slightly lower office space requirement. Space which is subsequently deemed surplus to requirement is often offered for subletting. In some cases, this can involve units larger than 10,000 sq m. Medium-sized and large companies are in a position to substantially reduce their office space requirements. However, in the case of smaller companies, the often poor flexibility of the rental space does not provide any scope for downsizing. Increasingly, the proximity to flexible office space providers, either in-house or in the immediate vicinity, is becoming relevant for tenants seeking space. This provides them with a certain degree of flexibility.

Take-up top 4 cities

Source: Avison Young

Status: March/April 2023

Office prime rents and office vacancy rate

Source: Avison Young

Status: March/April 2023

Berlin office market

| Q1 2023 | Compared to previous year | Outlook* | |

| Take-up (m²) | 140,500 | -17 % | ↓ |

| Prime rent (€/m²/Month) | 44.00 | +3.00 € | ↑ |

| Average rent (€/m²/Month) | 28.70 | +0.40 € | |

| Vacancy rate (%) | 4.0 | +110 bp | ↑ |

* in each case by end of year,

except take-up: compared with previous year

Source: Avison Young

Status: March/April 2023

Take-up, vacancy and prime rent

Source: Avison Young

Status: March/April 2023

Take-up by Top 5 Sector

Source: Avison Young

Status: March/April 2023

Top 5 Deals

Boston Consulting Group (BCG):- 19,200m²

„AP 15“ – Mediaspree

Jobcenter Marzahn-Hellersdorf:- 12,800m²

East

ASML Berlin GmbH:- 10,100m²

„Behrens-Ufer“ – East

PAO Gazprom:- 5,500m²

„the Graph“ – Friedrichshain-Kreuzberg

BIMA:- 5,300m²

Completions

Source: Avison Young

Status: March/April 2023

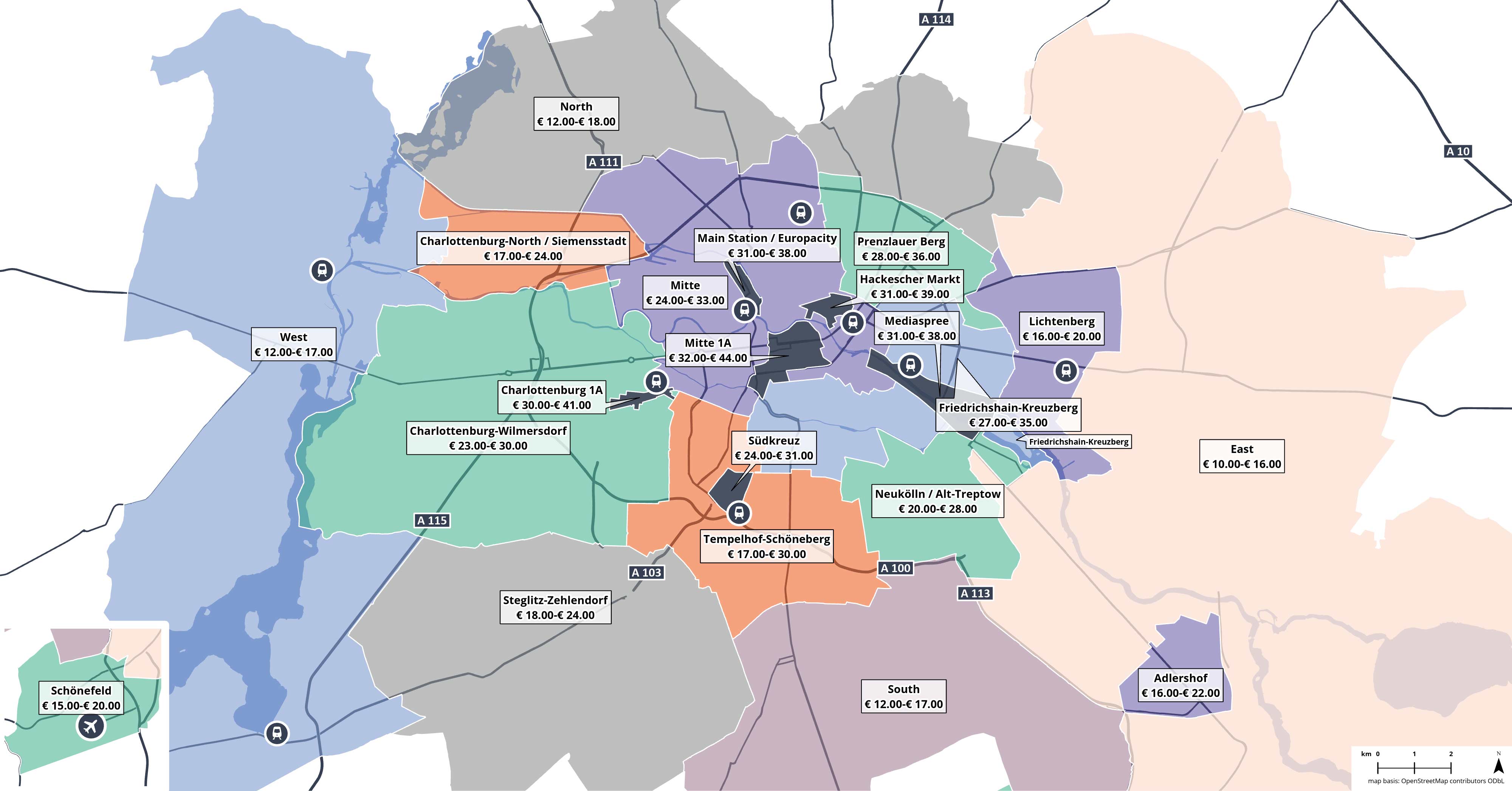

Rental bands – Berlin q1 2023

Source: Avison Young

Status: March/April 2023

Dusseldorf office market

| Q1 2023 | Compared to previous year | Outlook* | |

| Take-up (m²) | 54,000 | -24 % | ↓ |

| Prime rent (€/m²/Month) | 38.00 | +9.50 € | ↑ |

| Average rent (€/m²/Month) | 20.20 | +0.40 € | |

| Vacancy rate (%) | 8.8 | +90 bp | ↑ |

* in each case by end of year,

except take-up: compared with previous year

Source: Avison Young

Status: March/April 2023

This paradox can be explained on the one hand by the highest demands for and low supply of good quality space available at short notice, and on the other, by the high volume of vacant space which, from the perspective of potential users, is often inadequate in terms of its location and/or building attributes. Moreover, there is a short to medium-term tendency to seek to reduce the size of office space occupied and to offer space for subletting that is surplus to requirement. Added to the high volume of space still available and already under construction, this tendency is expected to lead to a significant rise in the overall vacancy rate with the vacancy rate possibly reaching double digits by the end of the year.

Take-up, vacancy and prime rent

Source: Avison Young

Status: March/April 2023

Take-up by Top 5 Sector

Source: Avison Young

Status: March/April 2023

Take-up by size category

Source: Avison Young

Status: March/April 2023

Top 5 Deals

Hengeler Müller:- 9,600m²

„Trinkhaus-Karree“ – CBD

NGK Spark Plug Europe:- 5,600m²

„The Square“ – Ratingen

Ed. Züblin:- 4,200m²

„F101“ – Airport City

SRAM:- 2,000m²

„Plange Mühle“ – Harbour

Blades 1775:- 1,400m²

Kennedydamm

Completions

Source: Avison Young

Status: March/April 2023

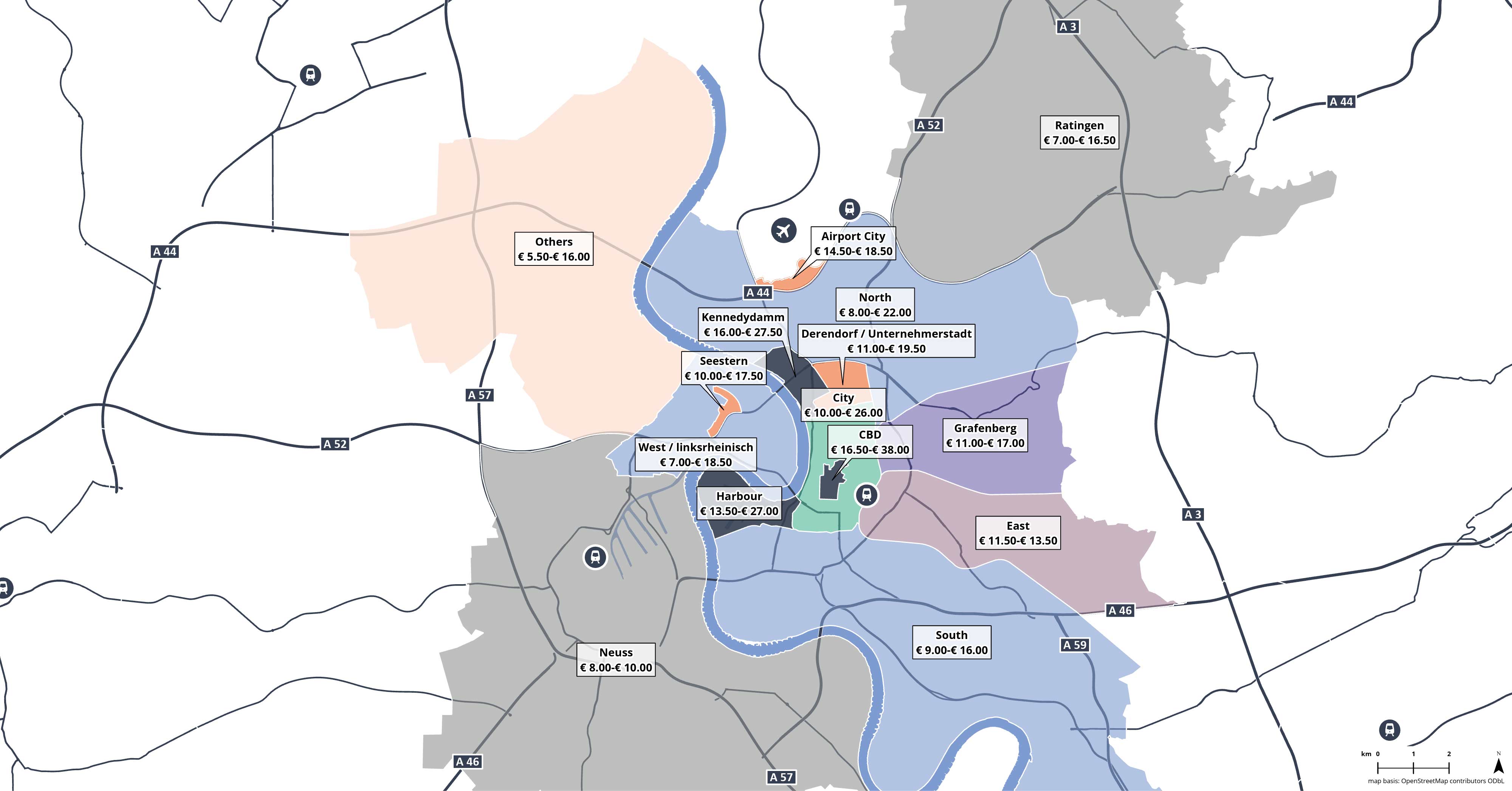

Rental bands – Dusseldorf q1 2023

Source: Avison Young

Status: March/April 2023

Frankfurt office market

| Q1 2023 | Compared to previous year | Outlook* | |

| Take-up (m²) | 85,000 | -21 % | → |

| Prime rent (€/m²/Month) | 46.50 | 0.00 € | ↑ |

| Average rent (€/m²/Month) | 23.80 | +2.50 € | |

| Vacancy rate (%) | 8.4 | +50 bp | ↑ |

* in each case by end of year,

except take-up: compared with previous year

Source: Avison Young

Status: March/April 2023

Take-up, vacancy and prime rent

Source: Avison Young

Status: March/April 2023

The vacancy rate in the first quarter of 2023 exceeded the 1 million square metre mark for the first time since 2017. Nevertheless, there is still a shortage of top-quality space in the highly sought-after locations. Moreover, very little adequate supply in the pipeline for central locations is expected to come onto the market over at least the next two years. One of the few exceptions is the FOUR skyscraper project. Even if demand for space remains relatively subdued, many Frankfurt companies are not making any concessions when it comes to quality, and so the prime rent, which has remained stable at EUR 46.00/sq m/month since the second quarter of 2022, should rise again by the end of the year to around EUR 48.00/sq m/month.

Top 5 Deals

Universal-Investment-GmbH:- 9,600m²

„Timber Pioneer“ – Europaviertel / Traid Fair

Öffentliche Verwaltung:- 9,100m²

Sossenheim / Rödelheim / Hausen

Massif Central Projektentwicklung:- 5,800m²

„Bethmannhof“ – City

Z.V.E.I:- 4,200m²

Airport

Sanofi-Aventis Deutschland Gmbh:- 3,400m²

Banking District

Completions

Source: Avison Young

Status: March/April 2023

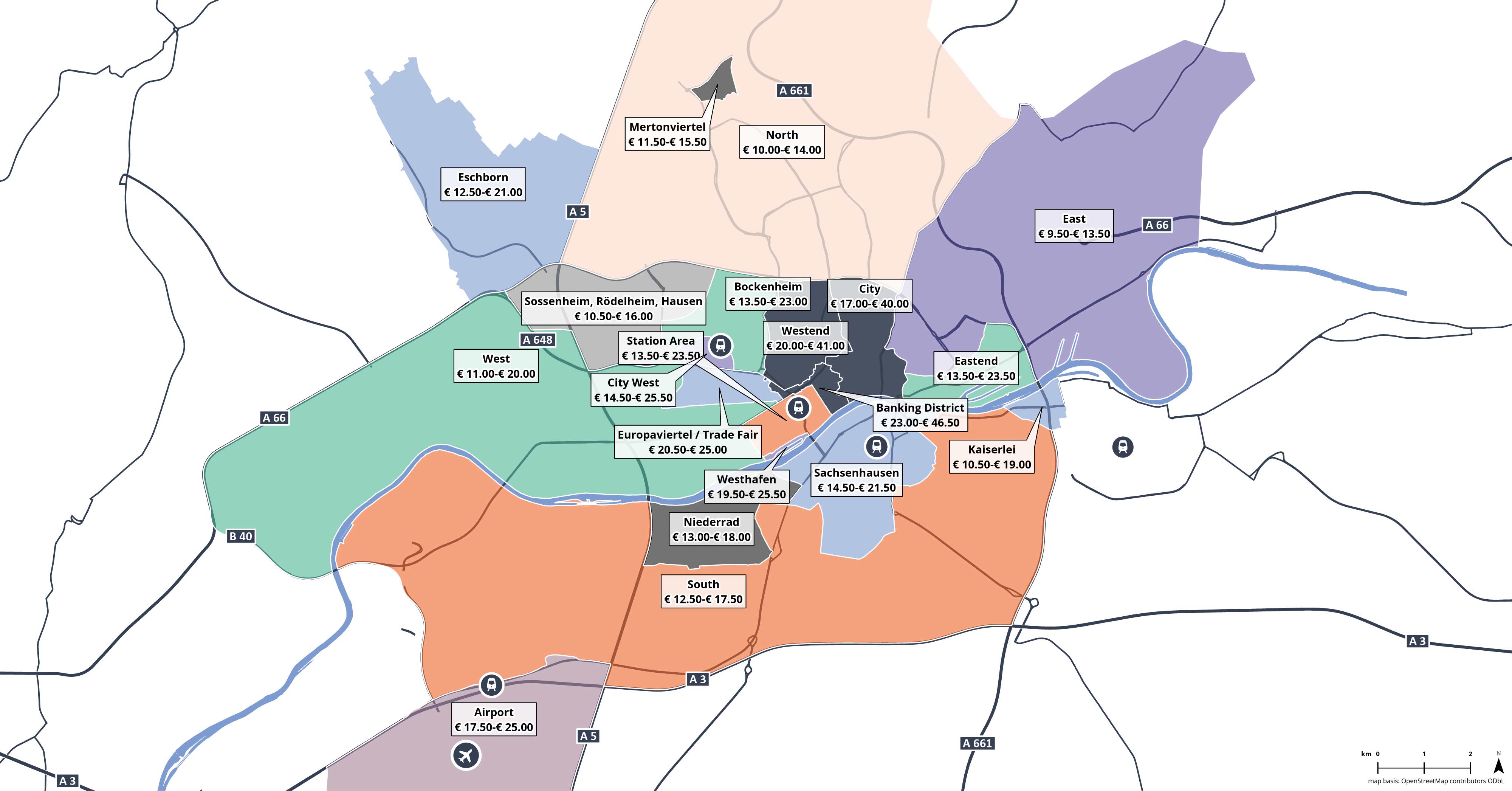

Rental bands – Frankfurt q1 2023

Source: Avison Young

Status: March/April 2023

Hamburg office market

| Q1 2023 | Compared to previous year | Outlook* | |

| Take-up (m²) | 103,000 | -17 % | → |

| Prime rent (€/m²/Month) | 35.00 | +3.00 € | ↑ |

| Average rent (€/m²/Month) | 20.90 | +1.70 € | |

| Vacancy rate (%) | 3.8 | +10 bp | ↑ |

* in each case by end of year,

except take-up: compared with previous year

Source: Avison Young

Status: March/April 2023

Take-up, vacancy and prime rent

Source: Avison Young

Status: March/April 2023

At the same time, an increasing number of tenants are considering whether it would be better to secure space now at the current rental levels for as long as possible in view of foreseeable rent rises. This is because prime rents in both the overall market and the individual sought-after submarkets are expected to rise further. Moreover, with vacancy rates remaining stable and very little available space coming onto the market over the next few quarters, landlords are able to minimise or even withhold incentives offered in the relevant properties due to the robust demand and limited alternative space available.

Take-up by Top 5 Sector

Source: Avison Young

Status: March/April 2023

Take-up by size category

Source: Avison Young

Status: March/April 2023

Top 5 Deals

Telefónica Germany GmbH:- 7,000m²

„Tichelhaus“ – City

IU International Hochschule:- 6,800m²

„Zeughaus“ – Eppendorf / Hoheluft

H-Tech:- 6.200 m²

Other

THU Harburg:- 5,010m²

Harburg

Edge Working Places:- 4,200m²

„EDGE“ – HafenCity

Completions

Source: Avison Young

Status: March/April 2023

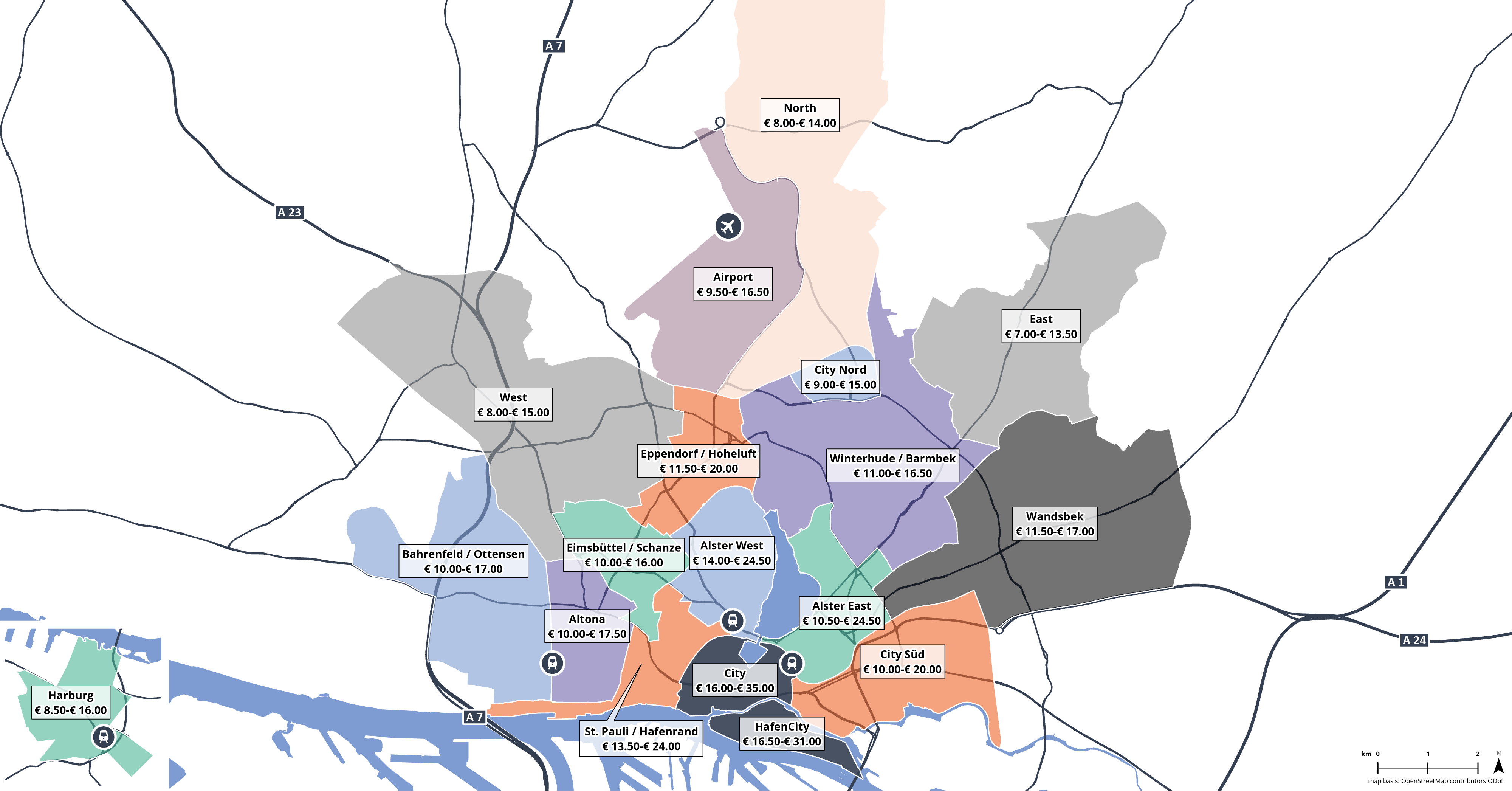

Rental bands - Hamburg q1 2023

Source: Avison Young

Status: March/April 2023

Contact